Cryptocurrency Trading 2021

Content

- Learn To Trade With Our Cryptocurrency Trading Course

- Analysing The Cryptocurrency Market

- Bitcoin: Will The Arrival Of Institutional Money Cause A New Price Surge?

- Risk

- What Might The Future Hold For Cryptocurrency?

Investors who speculate that bitcoin is overvalued or exists in a price bubble may wait for a downward trend to start before shorting bitcoin. Traders who trade bitcoin based on valuation metrics predominantly follow a fundamental trading style, analysing the suspected intrinsic value of an asset against its market price.

- This website uses cookies to obtain information about your general internet usage.

- Stop-loss orders work at the opposite end of the spectrum and will activate when stock drops to a predetermined amount.

- Miners are incentivised to create Bitcoins because if they solve a mathematical puzzle that creates a new Bitcoin, they currently get rewarded with 12.5 Bitcoins – that’s a lot of money.

- Trade fees – This is how much you’ll be charged to trade between currencies on their exchange.

Its top 10 holdings include Taiwan Semiconductor Manufacturing and Samsung. Coinbase and Binance are two of the world’s largest bitcoin trading platforms. They are touted as the easy and fast way for new users to purchase various cryptocurrencies such as bitcoin. Other ways to buy include the digital currency app Ziglu and on the investment platform eToro. Of course, cryptocurrency carries risk like any other investment. However, the gains and losses of cryptocurrency tend to occur much faster than with other currency investments. Successful traders and investors have built digital fortunes thanks to the volatility of Bitcoin.

Learn To Trade With Our Cryptocurrency Trading Course

Although it’s an exciting market with a reputation for making the lucky few substantial profits in a short time frame, it is by no means easy to trade bitcoin, and there’s huge risk involved. Rapid City in America has some of the craziest weather in the world – a bit like how volatile crypto prices can beIf you do invest, be prepared to lose some or all of your money. Bitcoin, the best-known and first major cryptocurrency, launched in 2009 and remains the market leader.

Try trading risk free using afree demo account with City Indexand for more trading ideas visit theCity Index Cryptocurrency trading hub. The main issue with cryptocurrencies is their ease of use. Today, it still requires some level of technological understanding to utilise cryptocurrencies to their fullest potential. As more projects and developers work on user interface and design, cryptocurrency offerings will become easier to use for the average person with little to no technical knowledge. Once this happens, watch out, because there will be no limit to how high cryptocurrencies can grow. First, cashless and mobile payments will continue to grow globally, helping in cryptocurrency adoption and usage.

Experts believe recent jumps in the price has been due to a wave of money from both institutional and private investors, spurred on by the coronavirus pandemic. Receive regular articles and guides from our experts to help you make smarter financial decisions. 67% of retail clients lose money when trading CFDs with this provider. They aim to achieve different things and can work in very different ways. Cryptocurrency is decentralised virtual money that works without the need of central banks.

A common mistake is getting caught up in the moment and risking more than you can afford. Set the budget where you are comfortable and know your limit. There is risk in trading and over stretching your budget will impact the decisions you make.

the cryptocurrency market has an advantage over forex and stocks market in that they are always open. What has happened in most cases is that people’s cryptocurrency was stolen in an attack on a cryptocurrency exchange, as we have explained above. Mt. Gox still has not been able to pay back all that was lost. Many people left their cryptocurrency in the exchange not realising how unsafe it was. Though, by using a CFD broker, you will not be able to use the cryptocurrency for any kind of transactions. cuts out having to store cryptocurrency, which comes with risks itself.

The process can vary between a few minutes to a few hours, depending on the size of the exchange and any network bottlenecks. Investors can expect to provide verification of identity themselves, at least for the reputable exchanges and service providers. The largest Bitcoin exchange in terms of volume is Bitfinex, although there are other high-volume exchanges such as Coinbase, Bitstamp, and Poloniex.

However, a key decision for traders starting out is whether to focus on technical or fundamental analysis strategies. There are several methods to shorting bitcoin, each with its own level of complexity, risk and reward. However, the methods below are all categorised as types of derivative trading, except from the traditional method of shorting via an exchange. Evident from its history, the price of bitcoin can appreciate as quickly as it depreciates. Traders with a high-risk appetite are drawn to volatile assets that have the potential to reap huge rewards, or equally huge losses. However, while some traders rely on luck, others utilise a structured approach based on experience and knowledge. Some traders short assets to hedge the risk of their larger portfolio.

In addition, you can trade your regular currency for Bitcoins at Bitcoin exchanges, the largest one being Japan-based Mt. Gox that handles 70 percent of all Bitcoin transactions. There are more than100,000 merchantswho accept Bitcoin for payment for everything from gift cards to pizza and even Overstock.com accepts it. If you’d like to read more, Dominic has put together a downloadable Beginner’s Guide to Bitcoin for MoneyWeek subscribers, which includes a bonus section on other cryptocurrencies. If you’re not already a subscriber, sign up now to get the report plus your first six issues free. In total, he spent $1.125bn buying 70,470 bitcoins, at an average of $16,000 per bitcoin.

The value of your cryptocurrency will rise and fall, but there’s no risk of immediately losing all your money to a bad trade. If this is what you’re looking for, you can either read on for a beginner’s guide or compare cryptocurrency trading platforms to get started. Long-term traders buy and hold cryptocurrencies over a long period of weeks, months or even years, with the intention of selling at a profit or using it later. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account.

Analysing The Cryptocurrency Market

These short-sellers tend to stay up to date with the latest bitcoin and blockchain advancements and not let opinions interfere with their objectivity. When going short and ‘selling’ bitcoin, the aim is to sell the cryptocurrency at a high price and buy it back at a lower price. Unlike most traders who like to buy low and sell high, short-sellers adapt the order of this philosophy and aim to sell high and buy low. If they are correct and the price drops, the bitcoin trader profits from the price movement between when they sold the asset, and when they bought it back. What seasoned traders use to examine bitcoin’s price are technical analysis and fundamental analysis. But remember that successful trading requires a lot of effort, money, and time.

This will help us to support the content of this website and to continue to invest in our award-winning journalism. “Stablecoins continue to develop and be the potential solution to the problems of volatility and credibility for cryptoassets. In contrast to cryptos, stablecoins have actual assets behind them, like regular currencies,” he says. The subscription details associated with this account need to be updated. Please update your billing details here to continue enjoying your subscription.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Commonly referred to as picking up a penny in front of a steamroller, scalping focuses on short-term trading. Also, it is based on the idea that achieving repeated small profits limits potential risks and opens opportunities for traders. Once you know the total amount of your first deposit, transfer it to your account and start trading as soon as possible. The cryptocurrency market is open 24/7 but it’s still good to know when regions and markets are active.

Bitcoin is at the “high-risk” end of the investment spectrum. The price of cryptocurrencies is volatile; some can go bust, others could be scams, and occasionally one may increase in value and produce a return for investors.

’ wasn’t yet fully answered, but that didn’t stop people from attempting to create their own. The most well known of these attempts came from Nick Szabo, a computer scientist who developed a cryptocurrency called Bit Gold in 1998. While Bit Gold was never fully launched, it is credited as paving the way for Bitcoin. You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade.

Bitcoin: Will The Arrival Of Institutional Money Cause A New Price Surge?

If the price contracted to a daily move of just 20 points, you’d be seriously interested and alert. This tells you there is a substantial chance the price is going to continue into the trend.

Follow our step-by-step walkthrough that covers how to short bitcoin via a leveraged trading account. Please note that it’s important to educate yourself on short-selling, leveraged trading and the bitcoin market.

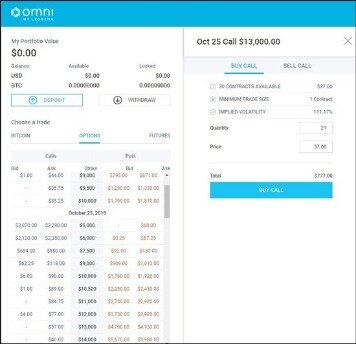

Futures contracts can now be accessed from several asset classes, including cryptocurrencies such as bitcoin. Futures are, however, a complex financial contract and may be better suited for experienced traders. A bitcoin options contract provides you with the option to buy or sell bitcoin at a specified price within a specific date range. Options contracts are recommended for advanced traders due to their level of complexity and the use of leverage. They are, however, a flexible option for short-selling bitcoin as you only initially risk the options contract premium.

Risk

With Bitstamp and Bitpanda, I found it straightforward to get set up and make deposits, ditto Gemini, which is the business child of the Winkelvoss twins. Buy small amounts of bitcoin, practise transacting in it, practise storing it. Get on top of the tech before you risk any significant capital.

Further to that, they will likely give you more money to play around with than you have. can copy the trades of others, sometimes automatically, however, this, of course, comes with risk. can also be considered, however, you will not be a trader, but more of an investor who has handed over their money to someone else to trade it for you instead. That said, a trading platform should also have useful tools for analysis, and as a bonus offer automated trading. MT4 is the most popular trading platform for all instruments, though some brokers may offer their trading platform. Though, be careful when researching as some people may have lost money and blamed their broker when in actuality it was because of their poor knowledge of trading.

The major exchanges include Coinbase, Bitstamp, Binance, Kraken, Bitpanda, Gemini, SFOX, crypto.com, CoinCorner, Bitfinex and eToro. Generally, the more you want to buy, the more paperwork you have to fill in. I recently tried setting up accounts with some of these and my findings were as follows.

This will take you several days, but it’s worth allocating the time. However, a wallet with Blockchain is not a long-term storage solution. It is just a starting point (you wouldn’t keep gold ingots in your wallet). Once you have an account, most exchanges will accept payments vie bank transfers and credit cards, as well as PayPal in some cases. For trading small amounts of Bitcoin, most reputable exchanges should be appropriate. These online wallets live on your PC desktop, or mobile phone . Like any investment, it is important to acknowledge the potential pitfalls and determine whether you’re comfortable with the risks associated with these instruments.

One of the early appeals of cryptocurrency was that it offers you the opportunity to transfer large amounts of your wealth anonymously without any government or institutional interference. These days, cryptocurrency is used by some owners to take care of routine matters such as paying bills. Let’s say you want to send your friend a small amount of Bitcoin. You create a transaction using your Bitcoin wallet and request to send Bitcoin to your friend’s wallet, agreeing to pay a nominal transaction fee along the way. After you make the transaction request, your transaction gets grouped with other transactions into a block on the Bitcoin blockchain.

There are enough investors and traders of cryptocurrency to make it an attractive form of currency to people around the world. It seems strange to some people that cryptocurrencies have value when most of them are not official products of a sovereign nation. However, the misunderstanding goes hand in hand with a misunderstanding of the definition of currency. Simply put, currency is anything that buyers and sellers agree will serve as a form of exchange between them. A cryptocurrency is a digital currency that uses cryptography as a means of security.

A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Cryptocurrency trading incurs many of the risks of trading on any other market, as well as some unique challenges. It’s good to test trading theories before throwing real money at them. The first step is to decide between long term or short term cryptocurrency trading. Do your research and work out whether cryptocurrency trading is right for you. This guide explains where to begin, including how to choose a trading style, how to devise a trading plan, what to look for in a trading platform and things to consider. Secondly, they are the perfect place to correct mistakes and develop your craft.