Are Blockchain Limitations Stifling Arbitrage Opportunities?

Content

- Are Blockchain Limitations Stifling Arbitrage Opportunities?

- What Methods Are Used For Crypto Arbitrage?

- Mining Bitcoin On Ethereum Blockchain Possible, Bitcoinereum

- Coding A Defi Arbitrage Bot

- Crypto Arbitrage Strategy

This allows a little longer period for the price differences. Crypto arbitrage comes with several advantages, thus a great option for most traders. It comes with fast profits compared to other trading strategies.

The authenticity of each transaction is protected by digital signatures corresponding to sending addresses, allowing all users to have full control over sending Bitcoins from their own Bitcoin addresses. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in Bitcoins for this service. Bitcoin is a decentralized peer-to-peer digital currency that is powered by its users with no central authority or middlemen. In the subsequent real-time settlement operation, OKEx reserves the right to temporarily close the real-time settlement function of some currency contracts in the case of extreme market conditions. Users can experience the real-time settlement function of the ADAUSD perpetual contract by using an API, web or the OKEx mobile app. Please visit the OKEx Support pagefor more information and details about the changes to the display of realized PnL, position and settlement records. This website uses cookies to improve your experience while you navigate through the website.

Are Blockchain Limitations Stifling Arbitrage Opportunities?

ECS does not gain or lose profits based on your trading results and operates as an educational company. Elite CurrenSea is a trading name operating in the interest of SonderSpot OU, Nenad Kerkez & Chris Svorcik. Please ensure your method matches your investment objectives, study the risks involved and if necessary seek independent advice. This site is not intended for use in jurisdiction in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Make sure to read full our full Terms of Use & Risk Disclosure. Therefore, make sure to take time to conduct research and carefully weigh your options.

Experienced traders, especially those who know how to spot an opportunity when they see one often have significant levels of success. While it might be easy to take advantage of a 20% margin between a buying price and a selling price, it’s only reasonable to find out whether or not the effort of completing a transaction will be worthwhile. Cross-border arbitrage can be much harder due to KYC regulations. Regulations are often stringent and traders can only transact upon providing a valid government-issued ID or other documentation to prove their identity. Moving on to cross-border arbitrage, it works almost similarly like the one above, with the major distinction being how the two exchanges involved in the transaction are placed in different countries. A trader can take advantage of this $250 margin by buying from Exchange X and selling on Exchange Y — effectively transferring funds from one to the other.

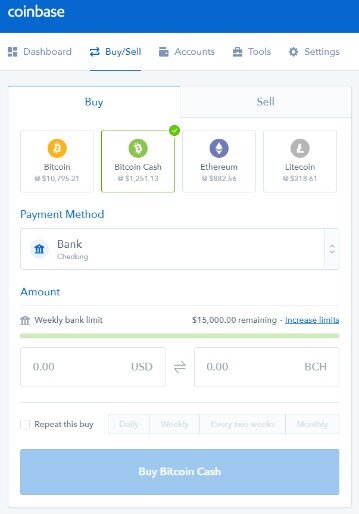

free 14-day trial, Bitsgap provides traders with all the information required to make educated arbitrage trades in an easy-to-understand format while a cloud-powered trading bot can execute trades automatically on your behalf. Even though manually trading arbitrage has proven to be safer it is time-consuming and could delay your trades which may result in missed trades or lost trades. The last thing that a cryptocurrency trader wants to encounter would be for their account or exchange to get hacked and wake up to find out that all your cryptocurrencies have been stolen. By using this arbitrage calculator, traders can assess risk management and efficiency needs which may otherwise be missed during the time to takes to conduct manual risk calculation. Before trading cryptocurrencies online make sure you investigate and perform background checks into the legitimacy of exchanges. So even though those prices across would rise in the market, those prices are rising at a rate different than brokers due to cryptocurrencies decentralization. Quasi-Automation Arbitrage – Identifies arbitrage trade opportunities and alerts traders through semi-automated scripts, trades are not automatically executed.

Member of the Financial Planning Association and the Economic Association of his country. He is very recognised in hiseld and attends frequently international conferences.

- There are options to make your account pro should you be handling larger sums of cryptocurrencies which greatly reduces transactional fees and may enable you to buy bitcoins for a 0% fee.

- To answer this question, we need to look at the key economic features of cryptoexchanges.

- It’s possible to arbitrate on a single exchange, however a little challenging.

- The US banks essentially felt as people were getting a cash advance since crypto is usable instantly and is basically like cash, cryptocurrency litecoin arbitrage trading binance software.

- Copy-trading and all the information in the app are presented in graphs and charts.

This concept fulfils the true essence of arbitrage and it is associated with minimal risk when compared with other approaches. For instance, shares in a tech firm might be on sale for $30 on the NYSE, but available for $30.25 in London. Indeed, the margin is quite small, but quickly bulk buying the shares at the lower price and selling them for a higher price can generate in a decent profit for a sharp-eyed trader. A “wallet” is basically the Bitcoin equivalent of a bank account.

What Methods Are Used For Crypto Arbitrage?

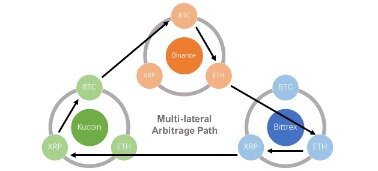

Spatial arbitrage involves capitalizing on different prices for cryptocurrency quoted on two different exchanges. Whereas Exchange X might be offering Bitcoin for $9,500, Exchange Y’s price might be set at $9,750. This is not the end of the story as there are other common types as well. For instance, another common type of trading for crypto derivatives traders is funding rate arbitrage. Interestingly, when a trader buys a cryptocurrency and hedges its price movement with a futures contract in the same cryptocurrency that has a funding rate lower than the cost of purchasing the cryptocurrency. Importantly, there is no such thing as a guaranteed profit.

The Amazon Market Place is not a single shop, but hundreds of thousands of individual marketplaces all brought together in a commonplace to allow simple price discovery, execution and payment. of whales dumping on BitMEX explaining the downward spiral of the Bitcoin market price. I bet you have heard this many times when discussing liquidity with your potential liquidity providers. If your trading is fairly standard, the volumes are reasonable, the flow is not toxic, and the asset class has deep liquidity, like FX, then I would say, “Yes”, they are correct. As a hub for HFT in crypto, Bitfinex is providing a host of proximity hosting services to meet this growing demand.

Cryptocurrency trading is a lucrative business, but there are challenges as well. Arbitrage trading is a relatively low-risk trading strategy that takes advantage of price differences across markets. Most of the time, this involves buying and selling the same asset as Bitcoin on different exchanges. Importantly, blockchain confirmation times don’t account for the trading venue’s own number of confirmations required for traders to have access to their assets and capital. Due to blockchain speed and security, such required policies suppress the potential of speedy trades and, in effect, hamper market liquidity at the time it’s most clearly needed from both buyer and seller. You Must find out reliable, secured and lawfully enrolled digital currency markets. It is better for dealers to choose some online trading platforms where they could buy and sell different types of cryptocurrencies.

Mining Bitcoin On Ethereum Blockchain Possible, Bitcoinereum

Broker B reflects a smaller trade volume while the price of one BTC offered by the broker is $11,510. Broker A reflects a higher trade volume while the price of one BTC offered by the broker is $11,500. Noticing how the Koreans tend to pay around 50% more for their cryptocurrencies, Mr. Helland pondered whether this could be an area of exploitation. Automated Crypto Arbitrage – Autonomously employed backtested strategies that are operated by an automated script that triggers trades. Manual Crypto Arbitrage – Manual trade management and input on trades. The same involves diversification and monitoring the market. Bitcoin takes the lead as the top crypto in every other thing.

In short, this is when an asset is simultaneously bought and sold in two markets, especially because they are being traded at somewhat different prices. Importantly, the challenge an arbitrage trader has is not only finding these pricing differences but also being able to trade them in a short period of time.

Coding A Defi Arbitrage Bot

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. PixelPlex developers have pointed out that one of the most important features of their platform is the built-in arbitrage bot, as it does crypto trading itself and helps users to make a profit. However, before deciding to participate in Foreign Exchange trading, you should carefully consider your investment objectives, level of experience and risk appetite. As demand for cryptocurrency trading continues to rise so will market inefficiencies. operates as a reliable and dedicated news outlet that has a reputation of providing information faster than competitors while also providing market tools and a price analysis breakdown on every cryptocurrency.

Trading crypto insights from the heart of the industry – the platform that delivers solutions and liquidity to institutions. If your user base likes using Coinbase for example, then a standard crypto kit solution such as the HollaEx Kit or even AlphaPoint is the best solution for building a crypto bank/exchange. Most people don’t know how to use a DeFi DEX style service. And most can’t afford putting up collateral in order to trade. It is important to think of the users that you’re trying to build for. Premiums have 20% can be offered and any automated market maker here could carve out a nice niche.

The more you execute, the more you will become better at it. It yet takes a little longer for some to update everything. Simple arbitrage is the easiest of the crypto arbitrage strategy. It involves looking into the price difference, then buying low and selling high.

Speed is of the essence when doing this type of trading, so BTC’s slow transaction time could hurt your chances of making a profitable trade. You may want to consider transferring funds between exchanges using ETH, which offers faster transactions, instead. As more traders become aware of the potential advantages of arbitrage, there may be increased competition for trades. Most crypto exchanges charge fees on trades, while deposit and/or withdrawal fees sometimes also apply.

The crypto exchanges are exploding, with traders taking up the digital currencies. Of all the trading options, arbitrage trading remains one of the most popular. Cryptocurrency trading is largely unregulated and disjointed, and the information transfer between exchanges is slow. There are also fewer traders and less competition compared to many popular investment markets, all of which can lead to potential arbitrage opportunities. The most basic approach to cryptocurrency arbitrage is to do everything manually – monitor the markets for price differences and then place your trades and transfer funds accordingly. However, there are several cryptocurrency arbitrage bots available online, designed to make it as easy as possible to track price movements and differences. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process.

Crypto Arbitrage Strategy

Simply put, Bisq is like an open-source eBay style currency exchange. Lastly, for business savvy people they may find the ability to add fiat currencies a major advantage. The exchange kit includes a bank plugin that, once switched on, will activate a fiat-to-crypto service that isn’t possible with a DEX system. Case in point, try building apps with your own bank account. Or if your a business try building your own financial solutions. But here lies the issue, nearly all financial technology or ‘fintech’ are closed off from public use and when we talk about your bank or an ATM likely the tech within these systems date back as far as the1950s.

Can you become a millionaire with Cryptocurrency?

Crypto is still a viable way to build wealth in 2020 and will continue to be in 2021 and the foreseeable future. Trading crypto is the way most crypto millionaires built their wealth, but it’s possible to mine your way to wealth if your cost is low, your output is high, and the coin you choose to mine is valuable.

Bitfinex has partnered with Market Synergy to offer institutional standard cryptocurrency connectivity. HFT firms seeking exposure to crypto can obtain secure connectivity via a FIX feed or ISP link to Bitfinex’s digital asset gateway. GBTC traded at a premium as high as 40% in late December as investors rushed to get exposure to anything in a crypto wrapper — more than double its one-year average premium of 16.3%. The fund has for much of its history traded at a premium to its underlying holdings, making the trade very profitable. However, as Bitcoin’s rally turns choppy and a stable of competing products attract attention, GBTC sank to a record discount relative to the value of the Bitcoin it holds.

There is a greater chance of price differences during periods of market volatility, so monitor crypto markets for any news and developments that could cause rapid price changes. While there’s always a certain level of risk when dealing with any crypto exchange, do plenty of research beforehand to make sure you only deal with reputable sites. Once you take into account processing delays and all the fees that apply, profits from successful arbitrage trades may be small.

How many millionaires are Bitcoins?

There are now as many as 100,000 people who have $1 million or more stashed in bitcoin, according to the cryptocurrency data-tracking firm bitinfocharts. That’s up from just 25,000 bitcoin millionaires three months ago.

But if your users are crypto experts then cloning the Uniswap code or building on Bisq could lead to more novel and experimental financial products. One downside to Bisq is the collateral requirement, meaning both parties that want to do an exchange are required to lock up their crypto in order to secure the trade. This makes developing and testing more complex for newbies.

Tradelize Social Network opens cryptocurrency trading to all levels of expertise. All trader profiles are completely transparent, and now users have the opportunity to verify statistics and statements made by traders. The company’s team of experts have commented on more details of their solution. To prevent and eliminate these issues, a graph theory-based optimal search algorithm was developed. PixelPlex, a global provider of blockchain-powered solutions, has announced the successful launch of a crypto arbitrage platform. The new application is designed to provide cryptocurrency traders with an effective tool with which they can grab the most beneficial deal. While this cause-and-effect remains, increased opportunities will arise for day traders to exploit market inefficiencies through cryptocurrency arbitrage.

Nevertheless, for this very reason, profits are generally slim in arbitrage trading and depend heavily on speed and volume per trade. As a reminder, that is why most arbitrage trading is done by algorithms developed by high-frequency trading firms. Cryptocurrencies have the potential to revolutionize the modern world.

Purchases can be made in a variety of ways, ranging from hard cash to credit and debit cards to wire transfers, or even using other cryptocurrencies. The chart is intuitive yet powerful, offering users multiple chart types for ARBITRAGE including candlesticks, area, lines, bars and Heikin Ashi. Use the flexible customization options and dozens of tools to help you understand where ARBITRAGE prices are headed. “We will start with the ADAUSD market as a trial and gradually launch other major tokens from early next month.”

When you browse the internet on your phone, your phone is probably using open-source Android. While browsing the web you’re probably using the Chrome app. When you visit your favorite website, that website most probably lives on a server operating on an open-source Linux OS.

With the presence of cross-border platforms that link sellers to buyers directly, the interest in arbitrage trading can only been seen to grow. One also needs to be careful of exchanges that offer very low prices for cryptocurrencies; some prices may be exceedingly below the market rate. While this may appear like a huge opportunity to make some tidy gains, it is worth checking whether an exchange is reliable in order to avoid losing your hard-earned capital. It could be due to hack borne out of bad security or an inability to make withdrawals.