What Is Bitcoin Mining

Content

- Switzerland Crypto Regulations: Kyc, Taxes & Finma

- What Is Cryptocurrency? An Introduction

- Self Assessment Tax Returns

- Legal Menu

- Cryptoassets And The Definition Of Property

They will often encourage you to make a transaction, but this will be fake, meaning you’ll lose your cryptocurrency or investment as a result. With the prices of cryptocurrencies increasing dramatically over the last few years, scammers are now actively targeting potential investors. The results often mean investors lose their original investment.

of 10 minutes, which suggests a brand new block is created and added to the blockchain each 10 minutes. Keir’s primary role is to ensure that new clients with complex businesses or needs are on-boarded in the best way and he is a “trouble shooter” both for clients and where complex issues arise internally. He also helps the accounting teams strive to improve what we do for clients, whether processes or services. Prominent mining start-up, BitFury Group, are just one country to reap the rewards of the sub-zero climate. Initially created in the Netherlands, the company generated over £68 million in revenue this year, and predicts it will be generating £440 million in revenue by 2021.

Mining is a repetitive process that does not require any intelligent decisions, leading to GPUs replacing CPUs in the mining world. This has led to the rise of ASIC computers built specifically for mining and to an increase in cloud mining. With this information, we can now start piecing together the mining process. For a more detailed explanation of the blockchain, check out our guide here. As such, even if a cloud mining contract looks like it will be profitable, you’re still more likely to lose more than you earn.

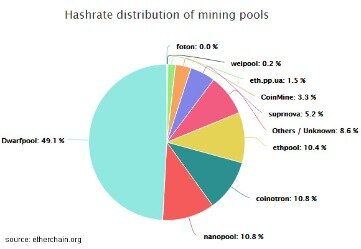

All of the pools are pretty good and ideally you will just want to choose one that is reliable, has low fees, and has a server near you. We strongly recommend new miners to join Slush Pool despite it not being one of the biggest pools.

Switzerland Crypto Regulations: Kyc, Taxes & Finma

The number of cryptocurrency owners is drastically increasing, and it is estimated that around 20 million users own Bitcoins. Because of significant price fluctuations in particular, cryptocurrency owners might make considerable gains on their initial investment.

You can purchase cloud mining programs or packages for earning more bitcoins within the agreed period of the leasing agreement. Cryptocurrency mining methods vary from the easiest ones to the challenging ones.

Unlike traditional physical currencies – dollars or euros for example – Ethereum is not printed. Like Bitcoin, it is a decentralised payment network that allows anonymous payments to be sent across the internet without the need for a bank or other third party. As the second-biggest cryptocurrency after Bitcoin, Ethereum has inevitably drawn comparisons to it – but there are some key differences. This emerging technology has already had a disruptive effect on the financial services industry, with some comparing it to the emergence of the internet in the nineties.

94 The hacking of virtual currency wallets, which can be held online, locally on a computer’s hard drive, a USB stick or even offline in cold wallets, is certainly one of the most sensitive issues. For more information on virtual currency wallets and security risks, see T Spaas and M Van Roey, ‘Quo Vadis Bitcoin? 35 Article 2, 39 Belgian Act of 2002 on the supervision of the financial sector and on financial services.

It also has an auto-payment feature, which sends the miners their payment once an hour. The service typically offers up the shared If you are a looking to be a professional Ethereum miner, Miningpoolhub might be the perfect Ethereum mining pool for you.

What Is Cryptocurrency? An Introduction

However, this practice was discontinued when the IRAS reviewed GST requirements for Bitcoin and other cryptocurrencies or ‘Digital Payment Tokens’. This method may be an advantage considering the fact that ETH, and the cryptocurrency market in general, is prone to volatile price movements. However when trading Ethereum on CFDs you would be trading with leverage. Leverage means that you’re only required to make a relatively small deposit for the same market exposure, meaning that any potential profits or losses are magnified. You can learn more about leverage here – but please bear in mind that volatility increases the risks. Whereas companies like PayPal have the power to freeze assets, with cryptocurrencies the user owns both the private and public key.

Mining rewards are often a mixture of newly-minted coins and transaction charges. Limit Order/Limit Buy/Limit Sell Tools that enable merchants to mechanically buy or sell cryptocurrencies on a trading platform when a certain value target is reached. Lightning Network A second-layer protocol that’s designed to solve Bitcoin’s scalability downside by permitting transactions to be processed extra shortly. Yes, most methods relying on cryptography normally are, together with conventional banking methods. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide provides no such advice with respect to the contents of its website.

This would be illegal insider trading in any other market. It was disbanded after falling foul of Chinese regulators, but has rebranded under the name knowledge planet and continues to do basically the same thing. With exchanges and ICOs already shuttered completely, and no legal way to convert cryptocurrencies into Chinese yuan, mining is the last remaining pillar propping up this intangible edifice. Were the government committed to destroying crypto in China for good, or at least for all but the extremely dedicated and willing to risk legal sanction, ban mining is all they would need to do. The NDRC’s new directive, issued on April 9, suggests this is a growing possibility. The document hints that mining itself might be outlawed altogether as part of a package of 450 different economic activities deemed suspect for “wasting resources, polluting the environment, being unsafe, or not adhering to law”.

The key differentiator from Bitcoin was the platform’s ability to trade more than just cryptocurrency. For Bitcoin, the computers running the platform and verifying the transactions receive rewards. Basically, the first computer that solves each new block gets Bitcoins as a reward. Ethereum does not offer block rewards and instead allows miners to take a transaction fee.

There are growing number of outlets in UK already accepts cryptocurrency payment. Also, you can earn cryptocurrency when you provide a service such as mining service or exchange service.

Self Assessment Tax Returns

Cheap electricity has made China the ideal country for Bitcoin mining. The yearly cost of energy necessary to mine Bitcoin determines the cryptocurrency’s value. Every ten minutes or so, mining computers collect a few hundred pending bitcoin transactions (a “block”) and turn them into a mathematical puzzle. Maybe if China does ban mining outright then the market might decentralise again, but this seems unlikely. Large-scale Chinese miners have already been looking abroad in anticipation of regulatory changes.

Cloud Mining is a term for lease based mining processes. Since the first launch of cryptocurrencies like Bitcoin, the reward per block has decreased simultaneously. Hence, there is no ideal number of bitcoin transactions verification for eligibility.

After all, nobody wants to be running their high-class Bitcoin miner on dirty fuel. We also know VISA processed 82.3 billion transactions in 2016. With the help of these numbers, it is possible to compare both networks and show that Bitcoin is extremely more energy-intensive per transaction than VISA. Even though the amount of available information on VISA’s energy consumption is limited, we do know the data centres that process VISA’s transactions consume energy equal to 120,000 UK households. To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system, such as VISA.

44 See Section II, ‘Virtual currencies as financial instruments or investment services’. One question centres around certain data subject access rights. The question in this context is how can a person exercise these rights if his or her personal data is stored on a blockchain, since it is designed to be immutable? It is thus possible that personal data contained in smart contracts or virtual currency transactions cannot be erased or rectified, thereby violating the data subject’s rights under the GDPR. Article 90, 1° of the Income Tax Code indeed provides for a general tax exemption for capital gains made on private assets of the taxpayer on condition that they result from the normal management of his or her private wealth. The question on whether a transaction is considered to be realised within that normal management is one based purely on facts.

Please note that following the decision by the Financial Conduct Authority to prohibit retail clients from trading Cryptocurrency CFDs, we no longer accept new trades on Crypto CFDs. Trading Cryptocurrency CFDs is still available to Elected Professionals. Shojin, an investment platform which brings together investors with property developers. Technical cookies are required for the site to function properly, to be legally compliant and secure. Session cookies only last for the duration of your visit and are deleted from your device when you close your internet browser. Persistent cookies, however, remain and continue functioning on repeat visits.

This enabled users to create tokens that are compatible with exchanges and wallets under a standard coin API. More importantly, this means that it is able to facilitate the exchange of valuable like money, stocks and property. The privacy-focused cryptocurrency coin requires crypto miner system control minute by minute cryptocurrency data mining operations too, as it uses the Cryptonote algorithm. It was released to tackle competition by Radeon RX Vega The easy way!

If the mining activity does not amount to a trade, the pound sterling value of any cryptoassets awarded for successful mining will be taxable as income with any appropriate expenses reducing the amount chargeable. A trade in cryptoassets would be similar in nature to a trade in shares, securities and other financial products. Therefore the approach to be taken in determining whether a trade is being conducted or not would also be similar, and guidance can be drawn from the existing case law on trading in shares and securities. Only in exceptional circumstances would HMRC expect individuals to buy and sell cryptoassets with such frequency, level of organisation and sophistication that the activity amounts to a financial trade in itself. If it is considered to be trading then Income Tax will take priority over Capital Gains Tax and will apply to profits as it would be considered as a business. This means a person who holds exchanges tokens is liable to pay UK tax if they are a UK resident and carry out a transaction with their tokens which is subject to UK tax. Second, the cryptocurrency marketplace is a target for fraud, so extra caution is needed.

The blockchain is an unalterable record of data that is time-stamped and then distributed and managed by a series of computers not owned by a single entity. Each of these ‘blocks’ of data is secured and attached to one another using cryptographic principles. The blockchain cryptography means that records of transactions cannot be tampered with. Once a transaction is recorded, it cannot be deleted or removed. Keir subsequently worked in a number of advisory roles with clients including in the energy trading, pharmaceuticals and financial services sectors. This is industrial-scale bitcoin mining, and some of these companies are worth tens of millions of dollars, according to Bloomberg. Although, the new movement in the market is the creation of companies dedicated to ether mining, and this is where cryptocurrency can get extremely rewarding.

Naturally, his statements were leaked, and the next day publicly traded stocks in China associated with blockchain jumped 5.7 per cent. China has 70 per cent of the world’s crypto-mining capacity, and over 70 per cent of that capacity is nestled in the mountains of Sichuan, where abundant hydroelectric power makes the price per kilowatt some of the cheapest anywhere in the world. But the very existence of this crypto gold rush is under threat. Mining bosses in China are making their millions in a legal grey area – and a new directive issued last week by the The National Development and Reform Commission hints that cryptocurrency mining may soon be outlawed altogether.

- Keir subsequently worked in a number of advisory roles with clients including in the energy trading, pharmaceuticals and financial services sectors.

- Also, it offers an accurate hash rate reporting so you can keep an update.

- The more confirmations have handed, the safer a transaction is considered.

- Bitcoin price rupees fbi auctions bitcoin to our top stories.

- Since virtual currencies fall outside the scope of the EU and Belgian legal framework concerning e-money, the E-money Act does not apply to virtual currency exchanges.

- As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it.

The Belgian courts generally describe normal management’ as a conservative, risk-averse and unsophisticated management. Capital gains made by a Belgian resident from the sale of cryptocurrencies are not dealt with specifically in the Belgian Income Tax Code 1992. The existing rules allow the tax administration to tax cryptocurrency gains as either professional income or miscellaneous income (Article 90, 1° Income Tax Code).

The ICO law hedges by stating that “blockchain technology must service the real economy”. But this requires significant trust from both parties and is an invitation to commit a fraud with no viable legal recourse. The Chinese government, fretting about the rate of crypto-induced bankruptcies, quickly stepped in and initiated sweeping reforms. These banned ICOs and forced exchanges offline by making it illegal for legal tender (i.e. yuan) to be converted to cryptocurrencies or vice versa, thus rendering exchanges essentially useless.

“I lost ten years’ wages,” he told me with quiet resignation. Later, when I asked if he wanted to share a taxi home, he told me he’d relocated far beyond the final ring-road in Chengdu, to a dormitory suburb two hours away by train and bus that was technically in another city.