Bitcoin Fraud Lawyers Kensington, London

Content

- Fake Exchanges And Wallets

- Malware & Viruses Hidden In Fake Bitcoin Wallets

- Mining Scams

- Bitcoin And Cryptocurrencies

Carbon credit originates from a range of emission reduction activities associated with removal of existing emissions from the atmosphere. These schemes have recently been reported more frequently as victims are approached by firms promoting carbon credit trading schemes. The FCA has warned that no money has been made from investment in carbon credits. Property Investment fraud occurs when scammers convince you to buy shares in a property or property bonds, often telling you that you are part of a group of investors . They will say they are buying houses to renovate, which you will make a profit on. The majority of these companies are not regulated or authorised by the FCA and may not even buy any properties to renovate and sell for profit. There are many types of scams fraudsters use to persuade you to part with your money.

By posing as a legitimate exchange and passing itself off as a branch of KRX, a large and reputable trading platform, it was able to ensnare innocent users. In December 2017, the Bitcoin community and South Korean authorities exposed a fake exchange known as BitKRX. Some will entice users with promotional offers that sound too good to be true.

Fake Exchanges And Wallets

However, people have been increasingly buying cryptocurrencies for the purposes of investment, hoping to make a lot of money quickly. Bitcoin is just one type of cryptocurrency, a form of digital asset or money that can be exchanged in a similar way to normal currency. There’s no physical money attached to a cryptocurrency, so there are no coins or notes, only a digital record of the transaction. Quick transaction times is one of the reasons people like cryptocurrencies.

- The regulators’ campaign includes tips on how to spot scams and what to do if you or a loved one have been directly affected by one.

- The price moves when interest changes, not when the investment case does.

- A fictional rendering of the MMM story, PiraMMMida, even became a “modest Russian movie hit”.

- Cybercriminals and fraudsters are using the anonymous, decentralised nature to operate scams and launder finances.

- The tried-and-tested “Nigerian prince” scam has also migrated into the world of cryptocurrency.

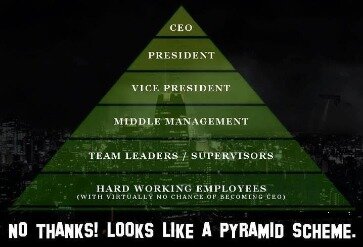

(For example, does it claim you’ll be able to double your investment?) This should raise a big red flag and is a common indicator of a scam. Use this checklist to help sort legitimate providers from those platforms you’re better off avoiding altogether. “I never called it a fraud because there’s no fraudulent thing going on. It’s just a pyramid scheme, you’re better that somebody is going to buy it. Even the miners are not guaranteed a return on investment and the false rising cost theory is very Scam O Rama. cent in electricity to compute and validate the transaction for which the miner was paid 25 Bitcoins while the last Bitcoin will cost an infinite number of dollars to mine in electricity and never pay out anything. I am guessing since there will only be 21 million Bitcoins and and payouts drop in half every four years.

Malware & Viruses Hidden In Fake Bitcoin Wallets

Cybercriminals and fraudsters are using the anonymous, decentralized nature to operate scams and launder finances. Secure bitcoin payments have many uses but as with any type of activity involving money, they can be a target for scammers. FCA. Report financial crimes here, such as investment scams and Ponzi schemes. Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. These types of pyramid schemes are nothing new and can be easy to spot, but that hasn’t stopped some crypto buyers being scammed in a handful of high-profile incidents. Something about cryptocurrencies attracts, not just starry-eyed naïfs, but the sort of starry-eyed naïf who thinks that Ponzis, chain letters and other blatantly fraudulent financial schemes are actually a good idea. Later cryptocurrencies haven’t done any better — when Ethereum took cryptocurrency and added smart contracts, the very first contracts people wrote were chain letters, lotteries and automatic Ponzi schemes.

Second, the cryptocurrency marketplace is a target for fraud, so extra caution is needed. Also, many exchanges have been subject to cyberattacks during which people who have left their holdings on these exchanges have lost them. statistics show that in June and July 2018 people lost more than £2 million to cryptocurrency scams – that’s over £10,000 per person.

Action Fraud are the national reporting centre for fraud and internet crime. They estimate people lose £1bn each year to Investment Fraud in the UK. The key overarching message for anyone thinking about investing money is to do your own research into the person or company offering the investment. The regulators’ campaign includes tips on how to spot scams and what to do if you or a loved one have been directly affected by one. The BOLT token, listed on Bitmax, the world’s first 3rd-generation crypto-to-crypto exchange, is paired against USD and BTC. More Bitcoin was traded on May 12th than any other day in history – with over USD 29 Billion. The BTC dominance in the market of cryptocurrencies is at an all-time high of 58.9% across the market cap of all cryptocurrencies.

And if you want to get in on the ground floor, the easiest option for the average person is to buy coins or tokens in an ICO. There’s a huge appetite for new digital currencies, and with many new buyers having limited knowledge of how the crypto industry works, it’s the perfect breeding ground for scammers.

Mining Scams

As with Mavrodi’s Russian schemes, part of the attraction is the site’s “quasi-Marxist ideology that attracts people angry at fat-cat bankers and government”. On one day alone last week, it shot up by more than 20% to $490 per coin. Some have questioned whether this is really down to Mavrodi , but the evidence for his involvement seems clear. Hundreds of “MMM evangelists” have taken to YouTube to post glowing testimonials about how “3M” has changed their lives. Sergey Mavrodi is one of Russia’s most infamous fraudsters in recent history; millions have lost their savings because of his MMM pyramid schemes.

Firstly, to buy and store a cryptocurrency is quite technically demanding and it’s very easy for things to go wrong. The lack of regulation and central authority means that seeking compensation or making complaints is also very difficult. Bitcoins and cryptocurrencies are created through a process called mining. Anyone can mine for most cryptocurrencies, but it is a difficult and time-consuming process. So, if you’re looking to buy or invest in Bitcoin or other types of cryptocurrency, you’ll have limited legal protection and a high risk of losing some or all of your capital. It is only by paying particularly close attention to your financial imperatives around planning, investments and retirement income that we can forge a relationship based upon clear and impartial advice. The first wants to make money quickly by capitalising on the interest and selling at a profit.

Scammers are offering effortless ways to acquire bitcoin through social media. This way, the scammers are able to access victims’ details and information, as well as compromise their existing bitcoin resources.

Reporting Investment Fraud

You’d then launch a second white paper in code outlining how many coins there would be and how they would be created. For example Bitcoin stated at the outset there would never be more than 21 million in existence. Before we try and answer the first question we must first understand the process of how cryptocurrencies are normally launched. What’s clear is the old saying – ‘if it’s too good to be true, it probably is’ – was trampled over by investors around the world who didn’t want to miss out on the next big thing. Instead they believed Dr Ruja’s claims that OneCoin would eventually be traded for real money and accepted in shops and restaurants as a form of payment. The shares will not be quoted on the stock exchange and will be virtually impossible to sell. You may find after you have remitted funds that you cannot contact the person who sold you the “shares”.

The theory is logical but in reality there is no correlation between the price of Bitcoin and the price of gold. What really drives its price, according to investment manager Fidelity, is simply human interest in Bitcoin. The upward price effect is amplified when interest rates go lower. The opportunity cost of owning gold, which pays no income, decreases as yields fall on rival “safe” investments such as bonds and cash saving accounts. Understanding why people buy gold is critical to understanding why people buy Bitcoin. Gold is considered a hedge against inflation as its supply is more or less fixed, whereas governments can print more money. If the money supply rises, as is happening with stimulus packages today funded by borrowing, then gold becomes more valuable.

I fear the last blockchain will include compute the value of pi until it repeats. Otherwise who will be left to verify transactions when there would be no more Bitcoin to mine? Therefore, trust is involved and Bitcoin undermines its own credibility without blockchain verification at minimum. It definitely got overvalued, but that’s what humans always do for everything. Once it consolidates and settles, it will serve its purpose well.

But it’s also possible to make huge losses in a relatively short space of time. In addition to wallets you can also trade your currency on exchanges. Some of these will also allow you to convert your everyday currency – £, $, € and so on – into cryptocurrency, and to convert your holdings from one type of cryptocurrency to another.

The victim is thus defrauded twice as no genuine attempt to recover the original funds is ever made. These scams are run from what the fraudsters call ‘recovery rooms’ and might even be carried out by the same group. Mr Mason encourages prospective investors to visit the FMA’s dedicatedinvestment scams webpages, or the Commerce Commission’spage on pyramid schemes. The FMA has seen a steady increase in complaints about a variety of scams since the beginning of March.

The actual coins themselves are “mined” and released into the blockchain by computers cracking complex coding problems. However, approximately every four years these codes become twice as complex, meaning the same computing power can only “mine” half the number of Bitcoin. Bitcoin and other “cryptocurrencies” are being taken extremely seriously by large and respected investors, tech chief executives, governments, criminal gangs and most importantly, the younger generation. It is not going anywhere soon and arguably its journey has only just begun. Paperwork issues – Bitcoin code, though complex, can be monitored and reviewed by anyone, anywhere. Crypto exchanges are now micromanaged by relevant taxation departments.

Bitcoin And Cryptocurrencies

There is no central authority in Bitcoin, just a clever piece of technology that supports its authenticity. It is currency that crosses borders without interference from middlemen, such as banks or governments. These factors combined, from an investing stand point, mean those who own Bitcoin already only expect the price to continue rising.

the central innovation of bitcoin is pretty much the “honest ponzi”. it functions by giving the early adopters a very direct monetary incentive to evangelize it automatically. Eventually the scheme runs out of new “greater fools,” the bubble pops, and a lot of people are left holding the bag. This is, again, why “market cap” is a misleading and useless number. This makes Bitcoin a zero-sum investment — the actual money coming out can never be more than the actual money coming in. You’re basically telling people “please don’t let the price drop, just sit and wait for new suckers to arrive”. DeFi, however, has now given blockchain the power to offer even more intricate financial uses.

Fraudsters now use platforms such as Facebook, Instagram and Twitter to lure people into investing in cryptocurrencies, foreign exchange and binary options. The scammers often have convincing social media profiles or websites with bogus reviews. Blockchain is the supposedly revolutionary technology which advocates say will transform finance and business. In essence, it is supposed to create a decentralised distribution chain – creating simultaneous copies of batches of data or transactions. The theory is that this eliminates fraud and allows companies and individuals to create more secure ways of doing business with each other that need not involve conventional banks.

Overseas holiday propertiesScammers lure in people with cheap overseas properties which don’t actually exist. Betting on whether the price of something will go up or down, for example gold, oil or stocks, and you can either win or lose. You will likely be approached either through a cold call on your landline or mobile or via an email or text. The questionable investment could be advertised on social media or in a pamphlet. The FCA also has a warning list so you can check if you’re dealing with a known scam. In the UK, a firm must be authorised and regulated by the FCA to do most financial services activities. The maker of hydrogen fuel cell-powered electric vehicles is absurdly pricey.

With Facebook about to launch its own coin in 2020, there is more investment in the eco-structure of cryptocurrency than any known Ponzi scheme. The question is whether to jump on board now in the hope of gaining the most benefits, or wait to test the waters. This sort of thing is illegal in traditional securities markets, but is a common occurrence in the largely unregulated world of cryptocurrencies.

However Lyfcoin is now trading at 8 cents, according to its website. He said that around the end of March 2019, Mr Rezaie mentioned a ‘buy back’ scheme where people would be able to sell the coins back to Lyfcoin, but this failed to materialise. Alarm bells started ringing when investors were told they were no longer able to cash-in their investment after five months. But they believe they have been scammed, after being sold Lyfcoin at $1.60 each only to later discover it was worth just 8 cents, the value of which appears to be from an in-house exchange.