[2020] A Guide To Trading And Investing In Cryptoassets

Content

- Which Are The Three Biggest Cryptocurrencies?

- Investment Scams In Focus: Cryptocurrency Scams

- Fintech Financial Services. Business News.

It is important that you understand that with investments, your capital is at risk. It is your responsibility to ensure that you make an informed decision about whether or not to invest with us. If you are still unsure if investing is right for you, please seek independent advice. Saxo Markets assumes no liability for any loss sustained from trading in accordance with a recommendation. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. 67% of retail investor accounts lose money when trading CFDs with this provider.

Gemini, founded by the Winklevoss brothers , is a digital exchange that allows customers to buy, sell and store cryptocurrencies. It was recently awarded an operational licence by the Financial Conduct Authority, and is regulated by the New York State Department of Financial Services.

In some instances, this means investors will have to pay foreign exchange fees as these exchanges will only accept deposits in dollars or euros. There are reports that this has proved hard for some people.

Which Are The Three Biggest Cryptocurrencies?

You need to have an idea of how long you want to hold your cryptos. For instance, if you bought Bitcoin in late 2017 when it was peaking, your investment would have lost nearly two-thirds of its value by the end of 2019.

The best approach to get into cryptocurrency trading is to immerse yourself in the markets. Trading are some things which takes time and energy to perfect. Even seasoned cryptocurrency investors make mistakes sometimes. One piece of advice which most traders agree on is the undeniable fact that you have got to push your way through negative experiences. You will be able to use a physical payment method to put your own money into cryptocurrency markets. for instance, it’s an honest idea to own a debit or credit card handy for investing.

Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. The more you put into crypto investing or trading, the more you can lose if things go wrong. To mitigate your risk when investing, it’s a good idea to diversify your portfolio by buying several different coins. With trading, you’ll want to figure out the maximum loss you can tolerate on each individual trade and manage your trade amounts accordingly. The latter of these can be more time-consuming and complicated, but at the same time you’re generally risking less in one go with trading than when investing. Several companies are planning to launch bitcoin funds, though have run into difficulties with regulatory agencies so far. The main purpose of it would be to facilitate the investing process into cryptocurrency and make the asset class more attractive.

To trade cryptoassets, you need an account with a trading platform that offers access to the crypto markets. With a mutual fund, investors pool their money together and entrust it to a manager who decides how to invest the overall sum. You can now find a variety of mutual funds that specialise in making cryptocurrency investments. The biggest and most well-known cryptocurrencies are the large-caps.

Fake wallets are scams for malware to infect your computer to steal your passwords and other personal information. If you’re looking to invest, consider the more traditional approaches in our Types of investment section. Firstly, to buy and store a cryptocurrency is quite technically demanding and it’s very easy for things to go wrong. The lack of regulation and central authority means that seeking compensation or making complaints is also very difficult. Bitcoins and cryptocurrencies are created through a process called mining.

In this case, it was a disagreement in relation to an increase in the block size. Ethereum has the potential to be an incredibly disruptive technology because it allows smart contracts to be written into the code on the blockchain. For example, it can be used to record banking transactions, legal contracts, and property deeds. This means that it has applications across a wide range of industries including financial services, law, and real estate.

Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network. The main risks of trading cryptoassets are volatility risk and leverage risk.

Hailed by fans as a market-disrupting liberation, and demonised by critics as a dangerous, volatile creation, bitcoin and other cryptocurrencies are never out of the headlines for long. On December 16, 2020, the price of bitcoin hit $20,000 for the first time. On January 3, 2021, its value soared above $34,000, meaning the cryptocurrency had gained almost $5,000 in the first few days of 2021.

Investment Scams In Focus: Cryptocurrency Scams

eToro’s platform is easy to use and gives traders the choice of buying cryptoassets outright or trading cryptoasset price movements via Contracts For Difference . It’s not unusual to see the price of a particular cryptoasset move 20% higher or lower in a single day. This means that the asset class can present many opportunities for traders and investors. With years of experience producing digital content related to the financial sector, from insurance to cryptocurrency and forex trading, Max oversees content production across Invezz. Using a crypto ETF you can invest in a coin without having to own them.

The price can move by 20 per cent in one day and you could easily lose half of your cash in a far quicker time that investing in the stock market. Remember bitcoin yields nothing and its main source of value is scarcity.

- With bitcoin rising in popularity across the United Kingdom, businesses and entrepreneurs are ensuring that they’re open to crypto payments across the board.

- Not only does the high level of volatility within the crypto market provide plenty of trading opportunities, but you can also trade around the clock, and use leverage to increase your exposure.

- Conflicting messages from too many self-proclaimed “experts” have paralyzed many would-be investors and prevented them from acting on their interest in this global financial phenomenon.

- Easier options for small amounts include Bittylicious and LocalBitcoins, or even bitcoin ATMs.

But while investor interest is surging again, regulatory warnings are getting louder. Anyone with access to a computer or smartphone can buy bitcoin through an exchange. You will have to pay trading fees on top of the cost of the bitcoin itself. eToro and Revolut, which allow everyday British investors to buy and sell bitcoin, told This is Money they had seen big increases in applications and the number of customers in December, when bitcoin reached a new all-time.

Fintech Financial Services. Business News.

The majority of Bitcoins are held by relatively few investors, and many platforms and exchanges trade cryptocurrencies on their own books. In a sales rush, liquidity issues could leave investors sidelined with rapidly falling prices. The first cryptocurrency was Bitcoin and it was soon followed by several competing ones such as Litecoin, Peercoin, Namecoin, Ethereum, Cardano, and EOS. The current value of all the existing cryptocurrencies is estimated at around $214 billion. The exchange rate between cryptocurrency and fiat money fluctuates widely because the market prices for cryptocurrencies are determined by supply and demand. With a unit of cryptocurrency, you have to pay in full for the price of the asset.

However, the currency cannot be owned directly in traditional tax-efficient accounts such as Isa and pensions. Bitcoin is nearing an all-time high on the news that major companies, such as Tesla, Mastercard and JP Morgan, are embracing the digital currency and a wave of mass adoption could be around the corner. Registered Hemscott users can log in to Morningstar using the same login details.

These are two different practices and understanding the distinction between them will help you choose how you want to make your first investment. In the last 12 months the cryptocurrency market capitalization increased almost fourfold, reaching $764 billion. The total value of all altcoins apart from bitcoin appreciated from $60 billion to $225 billion – by more than 270%. Like many other industry experts, I believe that this trend will persist in 2021. No one can tell you exactly what to do with your money, but you can make smarter investment choices by learning about the assets you want to purchase.

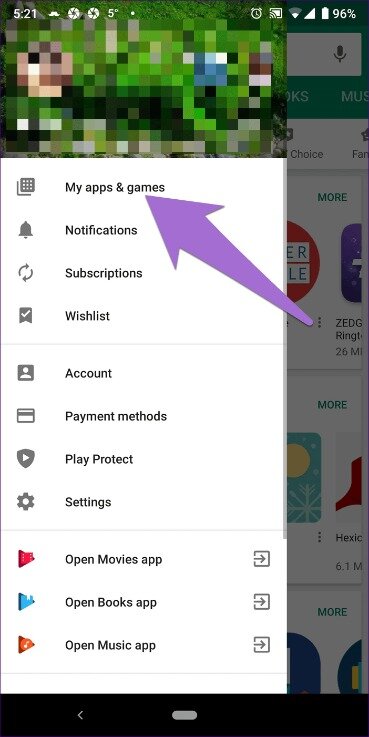

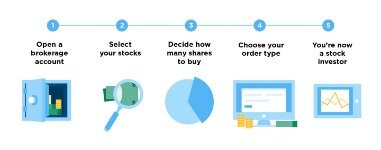

One of the features that cryptocurrency lacks in comparison to credit cards, for example, is consumer protection against fraud, such as the chargeback facility. There is no guarantee that cryptoassets can be converted back into cash, which leaves consumers at the mercy of supply and demand in the market. If you simply want to trade cryptocurrency you just need a brokerage account, rather than accessing the underlying exchange directly.

More From Money

Investing is a risky business and like any type of trading, the value of what you buy can go up or down. Make sure you are informed before jumping in the driver’s seat. To buy cryptocurrency, go to the Cryptocurrencies section of the Revolut Dashboard, accept the T&Cs and start exchanging crypto in minutes. Access the feature directly in the Revolut app and start exchanging cryptocurrencies today. Bitcoin accounts for 2.5pc of assets in the £475m Ruffer Investment Company and its £3.5bn Total Return Fund. It said Bitcoin was a tool to diversify the funds and act as a hedge against low interest rates. This ETF, which has the stock market ticker BCHS, from American fund manager Invesco tracks a basket of companies deemed to have the “potential to participate in the blockchain ecosystem”.

it is great preparation for when digital money might go fully mainstream in the years coming. In the meantime, do take an in depth look at investing in cryptocurrency, and tread carefully.

The prognosis is quite futuristic but still, it may prove true. Like any other high-income instruments, cryptos are associated with high risk although potential dividend rates muffle “the voice of doubt and fear” in the investors’ minds. To understand cryptocurrency, you have to understand blockchain. Blockchain is the technology that makes cryptocurrencies secure and anonymous. Basically, blockchain provides a digital record of transactions, and stores copies on multiple devices across a global network whenever the record is updated.

As cryptocurrencies aren’t asset-backed or centralised, their value is subject to sudden large increases or decreases. Think of the price as an agreement on what people are willing to pay for a Bitcoin rather than a predictable figure based on, for example, the price of gold. Many users also favour the anonymity that cryptocurrencies offer – transactions are much harder to trace than those made by cash or credit. Before a new cryptocurrency is launched on an exchange, you will be able to buy cryptocurrency coins or tokens as part of an Initial Coin Offering . This is usually what’s known as a pump-and-dump – when a price becomes inflated at launch, and then rapidly crashes.