A Guide To Investing In Cryptocurrency

Content

- How And Where Can I Buy Bitcoin From Britain?

- Huge Surge In Britons Investing In Cryptocurrencies Like Bitcoin

- Risks

- Trading Via A Cfd

- What Is A Crypto Wallet?

Any bitcoin will be bought and held by Revolut on the investors’ behalf, meaning they won’t actually possess it themselves, but do still have the rights to it, even if they can’t use it to buy anything. The same can be said for Bittrex, which charges card and foreign exchange fees, but it also has a similarly low trading cost of 0.2 per cent, or £1 on a £500 trade. Buying the same amount’s worth of bitcoin through Binance would cost £9 with a debit card or nothing with a bank transfer, coupled with a 50p trading fee as it charges just 0.1 per cent on trades of up to 50 bitcoin. As well as that documentation, exchanges may levy a variety of fees depending on the payment method investors opt for.

Since 2009, a wide range of challenger cryptocurrencies, dubbed altcoins, have arrived on the scene. Thanks to the risk management tools offered by this platform, every user can protect their positions and enjoy deposits and withdrawals without complications and instantaneous execution. In addition, eToro offers its new members a free $100,000 account with which to measure and test their strategy. The man who managed to break the Bank of England was skeptical at the beginning of the year regarding virtual currencies, now however he gives its fund manager the go-ahead to start operating with these assets. Kuflink is a registered European Community trademark (No. & ) of Kuflink Group Plc.

There are many competing sites so it’ll be worthwhile searching for an exchange that suits your needs as well as your experience level. Some individuals have made lots of cash from cryptocurrency investment but it carries many risks.

Even if you compare them to other unstable assets such as oil. Development is underway to make cryptocurrency easier to use, but for now it isn’t very ‘money-like’. This is why central banks now refer to them as “cryptoassets” instead of “cryptocurrencies”. It’s generally slower and more expensive to pay with cryptocurrency than a recognised currency like sterling.

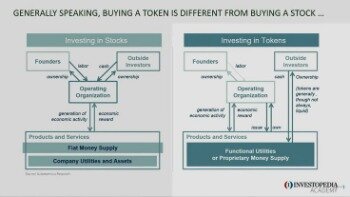

Bitcoin was the first cryptoasset to be launched and remains the world’s largest cryptoasset by market capitalisation today. This is the technology that many popular cryptoassets are based on.

How And Where Can I Buy Bitcoin From Britain?

Instead of Bitcoins people might be much better off speaking to a local IFA – via Vouchedforor Unbiased– who will be able to recommend a investment strategy tailored to their own particular attitude towards risk. Consequently any government ‘ban’ could wipe out the value of crypto-currencies. Adviser Scott Gallacher explains the pros and cons of investing in digital currency. Earlier this year the Financial Conduct Authority released a statement saying that cryptocurrencies were not regulated provided they were not part of other regulated products or services. Riot Blockchain intends to gain exposure to the blockchain ecosystem through targeted investments in the sector.

In 2018, MPs called cryptocurrencies a “Wild West industry”Extreme volatility is perhaps the most defining factor of the cryptocurrency market. To put bitcoin prices into investment profit and loss terminology, if you had invested at the start of 2020, you would be sitting on a 300% profit by the end of the year. However, if you’d invested at the start of 2018 and sold at the end of the year on New Year’s Eve, you would have lost 73% of your money as the bitcoin price collapsed. All investments entail a risk and may result in both profits and losses. In particular investments in leveraged products, such as but not limited to foreign exchange, derivatives and commodities can be very speculative and profits and losses may fluctuate both violently and rapidly. Any mentioning herein, if any, of any risk may not be, and should not be considered to be, neither a comprehensive disclosure or risks nor a comprehensive description such risks.

Similarly, if you’re willing to trade the same amount – a similar approach can stop you from losing too much during your learning curve. When investing or trading you’re looking to grow your money over time, so the amount you start with will give you an indication of the potential returns you’re likely to see. If you have a couple of hundred pounds to invest, you might want to consider investing it in a prominent coin; whereas if you have more at your disposal then you could consider trading a variety of cryptocurrencies at once.

Huge Surge In Britons Investing In Cryptocurrencies Like Bitcoin

Criminals can use services which hide their IP addresses to prevent their browsing history from being traced and use multiple wallets. One relatively new scam consists of fraudsters setting up fake trading websites that do not provide genuine trading facilities. Then, they are encouraged by the scammers to ‘invest’ using cryptocurrency and they are shown high profits supposedly generated by these fake trades. When the client wants to make a withdrawal of their significant profits, they are directed to a seemingly genuine ‘bank’ to set up an account. That ‘bank’ is actually fake and forms part of the overall scam. Further payments are requested to encourage the client that the withdrawal will be processed.

Larger tokens like Bitcoin may have a higher barrier to entry, but they have also proven their staying power. Yes, it’s possible that sudden government regulation of the industry could cause complications for Bitcoin’s growth, but it’s also true that investing in Bitcoin is easier than ever before. Secure online services that allow you to convert money back and forth between conventional currencies and various cryptos are beginning to pop up, and merchants are beginning to accept Bitcoin as payment for goods and services. If these enterprises cause Bitcoin to replace conventional money , then early adopters of cryptos stand to make a killing. While anonymity offered by various cryptos has certain advantages for businesses and their customers who use tokens to conduct transactions, it also poses a risk to investors.

- In countries like the UK, it is already notoriously difficult to start a crypto asset company, and many other nations are following suit.

- However, he expressed doubts as many as 19 per cent of the country now held cryptocurrency, even if there had been a surge in interest.

- Bitcoin is at the “high-risk” end of the investment spectrum.

- Owning KR1 shares is a way of owning a spread of different cryptocurrencies inside an Isa or Sipp.

- This is why central banks now refer to them as “cryptoassets” instead of “cryptocurrencies”.

But not all professional investors are put off by Bitcoin’s volatility and newcomer status. Tancredi Cordero of Kuros Associates, an investment consultancy, said the most important reason to own Bitcoin was that it acted as a “hedge” as its price moved in different directions from other investments, including gold. British fund house Ruffer became the City’s first major investment company to buy Bitcoin for DIY investors last year when it added £550m of the digital currency to its funds. There are, however, a number of ways investors can track the value of Bitcoin and other cryptocurrencies via Isas and pensions. It depends on whether you believe bitcoin will rise in value.

Risks

It groups transactions into ‘blocks’ that are chained together and uses cryptography to secure and verify all transactions. For clients of eToro Aus Capital Pty Ltd, all crypto positions are CFDs. For clients of eToro Ltd, all leveraged and SELL crypto positions are CFDs. Non-leveraged BUY crypto positions are secured with real assets. From 3 September 2017, non-leveraged BUY crypto positions are secured with real assets. Any such positions opened before this date were upgraded to real assets on 13 May 2018.

This means there is a higher level of security relative to a ‘centralised’ ledger, where data is stored in one place. A community to discuss the future of financial services and any other interesting trends, strategies, ideas, views. Blockchain also allows cryptocurrency transactions to be anonymous. You can’t always see who is buying, selling, or using a given token. Prior to blockchain, most digital records were stored in a single server bank.

We’ll also try to limit any suspension so it lasts as short a period as possible. because we are changing our services or products, or adding new ones. Scott Gallacher is a director and chartered financial planner at Rowley Turton, he also blogs for the VouchedFor website. The price of Bitcoins, on the other hand, has been very volatile. Whilst this has lead to the price rising sharply there have also been very sharp falls; consequently Bitcoins are not for the faint hearted.

Investing in anything always comes with risk meaning you can always lose money but the big disadvantage of cryptocurrencies is its extreme volatility. There have also been reports that people have had to wait to get their cash out because of technical snarl-ups.

Before you begin your cryptocurrency investment journey, you need to decide which coins you are going to target, and, ideally, understand the technology, known as blockchain, that powers them. eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets. Create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more. This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital.

Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network.

WALLET – a secure online place where your cryptocurrency is stored. Five of the most well-known cryptoassets are Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and XRP. Placing a cryptoasset trade on eToro is straightforward, whether you’re looking to buy the underlying asset or trade the asset’s price movements via CFDs.

It said Bitcoin was a tool to diversify the funds and act as a hedge against low interest rates. Its share price has risen from 4p to 167p in the past 12 months, a 4,000pc gain.

Where we give providers or products a customer experience rating or a product rating, these are compiled against objective criteria, using information which has been collected by our partnerFairer Finance. In some cases, we may provide links where you may, if you choose, purchase a product from a regulated provider with whom we have a commercial relationship. If you do purchase a product using a link, we will receive a payment. This will help us to support the content of this website and to continue to invest in our award-winning journalism.

Do you want to start investing in cryptocurrency but are not sure where to begin? You are not alone; many people want to get started with cryptocurrency but do not have much knowledge about this relatively new and complex form of currency that seems to be everywhere this day and age. As with any type of investing, you must have a clear understanding of how it works so that you can be smart with your money and make the right decisions. Here is what you need to know to get started investing in cryptocurrency. Giambrone’s lawyers are highly knowledgeable in dealing with financial fraud and can provide advice if you suspect that you have been scammed or you broker is evasive when you attempt to withdraw your funds. Even though cryptocurrency has an air of secrecy, every transaction is publicly available and can potentially be linked to a specific exchange. A Norwich Pharmacal Order (“NPO”) could also provide a means of discovering the identity of the wrongdoer by forcing intermediaries to disclose the private details of their customers.

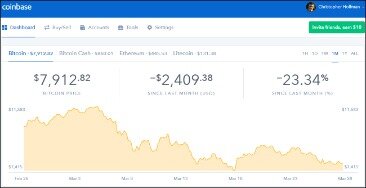

The process for purchasing cryptocurrency through platforms like Coinbase is as simple as making an order on Amazon. You simply create an account and link it to your credit card or bank account. Once you have done this, you can purchase a number of different cryptocurrencies, with Coinbase taking a small brokerage fee , for exchanging your fiat currency for shiny new cryptocurrency. The answer is that there are a number of places to get started with cryptocurrency acquisitions, although Coinbase, headquartered in Silicon Valley, seems to be the platform of choice for the Western world’s crypto enthusiasts. There are of course a number of other great online platforms to buy cryptocurrencies in the UK, so certainly do your research to find the best one for your individual needs. If you have been reading LLM – Luxury Lifestyle Magazine for a while now, you’ll know that we are very interested in the emerging world of cryptocurrencies.

The price or value of cryptocurrencies can rapidly increase or decrease at any time. Unlike normal money, no bank or government can stabilise the value of cryptocurrency if it changes suddenly. It is important that you understand that with investments, your capital is at risk.

What Investment is committed to exploring the best opportunities in the investment trust market. Investment Trusts are covered in every edition of the magazine, and in alternate months we delve into the best opportunities in our special investment trust section. Readers who have been with What Investment since its launch over thirty years ago regularly tell us that their subscription is one of the best investments they have ever made.

The ETNs own the underlying physical coins and aren’t traded on leverage, which would amplify your risk. Bitcoin can be stored in digital “wallets” on some trading platforms, while others also allow it to be transferred out into more secure online wallets or even on to hard drives. “All this, along with issues around fraud and theft, drastically limit its merits for a serious investor. For those who want to take a small gamble on volatility, fine. But it should not be an investment choice as part of a considered strategy and portfolio,” he said. Simon King of Vermeer Partners, a wealth manager, said Bitcoin faced two main hurdles before it could be considered investible. He said it needed to be used as a means of exchange, like other currencies, but this was currently not the case.

To make money from investing in cryptos, you’ve got to carry out a deep study on the plain coins. This way, you’ll be more informed about the coins you would like to invest in and understand the utility it contributes to the cryptocurrency world. Several companies are planning to launch bitcoin funds, though have run into difficulties with regulatory agencies so far. The main purpose of it would be to facilitate the investing process into cryptocurrency and make the asset class more attractive. It will still be volatile, but it could be easier to sell your investment and get your money back than investing directly.